This number is issued to persons who are required to report their income for assessment to the Director General of Inland Revenue. Value-Added Tax or VAT is a type of indirect tax levied on the price of goods or services at each stage of production distribution or sale to the end customer.

Vat Number The Ultimate Guide Bansar China

Corporate Identification Number Indonesia.

. The last six digits are the registration number sequence. Vat number malaysia Pay uk vat to enjoy all benefits provided by this taxation system. You may definitely be in a.

CUIN Incorporation Number NTN National Tax. So turns out you do need to register for tax in Malaysia. 04 local limited liability partnership LLP 05 foreign LLP.

NIB Nomor Induk Berusaha NPWP Nomor Pokok Wajib Pajak Japan. Firms may discover their own VAT registration number on the VAT registration certificate given by HMRC whereas the VAT registration numbers of other businesses should be disclosed on any invoices issued by those. The most common tax reference.

It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1 June 2018. This serves to identify your company in the VAT administration process. An Income Tax Number or Tax Reference Number is an unique identifying number used for tax purposes in Malaysia.

When entering your VAT number it must include the two letters that identify your EU member state eg. 1 Income Tax Number ITN The Inland Revenue Board of Malaysia IRBM assigns a unique number to persons registered with the oard. Being aware of the particular list of eu countries that follow vat can help save money Starting an organization that is going to import services or goods to the UK can be difficult during these competitive times but understanding the range of eu countries that follow vat may help reduce costs.

The only difference is formal. This unique number is known as Nombor ukai Pendapatan or Income Tax Number ITN. The first four digits representing the year of registration.

But once your local sales do surpass MYR 500000 then you may have to register for VAT and comply with all of the Malaysian rules around tax rate and collection invoices and filing returns. What is a VAT registration number. It is also commonly known in Malay as Nombor Rujukan Cukai Pendapatan or No.

This is what the VAT number looks like in our example. Unified Social Credit Code 统一社会信用代码 Hong Kong. The first two letters indicate the respective member state for example DE for Germany.

02 foreign company. VAT is the global market leader for high performance vacuum valves. Your VAT number is almost identical to your company number.

Mission-critical components for advanced RD and manufacturing processes of semiconductors LED solar cells displays and other high vacuum demanding products. This one-of-a-kind number is referred to as the Nombor Cukai Pendapatan or Income Tax Identification Number ITN. DK for Denmark EL for Greece and GB.

This number is assigned to individuals who are obligated to disclose their income to the Director General of Inland Revenue in order to be assessed. A VAT number sometimes known as a VAT registration number is a unique code that is assigned to businesses that are required to pay VAT. Corporate Number 法人番号 Pakistan.

In order to identify VAT-payers countries under the Value-Added Tax scheme issue the VAT number which represents the unique taxation number of the entitys taxation under the VAT. 08022022 By Stephanie Jordan Blog. The VAT number starts with BTW BE followed by the company number.

Vat has been employed as a way of collecting taxes on goods and services in the majority of of Europe as well as the UK too follows this method. The vat department in the United Kingdom is headed by HM Revenue and Customs or hmrc. Company Registration Number Tax Number VAT Number.

Please contact Malaysias tax agency for more information. 28 rows A value-added tax identification number or VAT identification number VATIN is an identifier used in many countries including the countries of the European Union for value-added tax purposes. Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018.

A VAT registration number is alphanumeric and consists of up to 15 characters. 01 local company. SST is administered by the Royal Malaysian Customs Department RMCD.

06 LLP for professional practice. It confirms that the number is currently allocated and can provide the name or. Lembaga Hasil Dalam Negeri Malaysia classifies each tax number by tax type.

The next two numbers are the type of business entity. GST was only introduced in April 2015. The Inland Revenue Board of Malaysia Malay.

In the EU a VAT identification number can be verified online at the EUs official VIES website. ITNs are only allocated to individuals and cannot be.

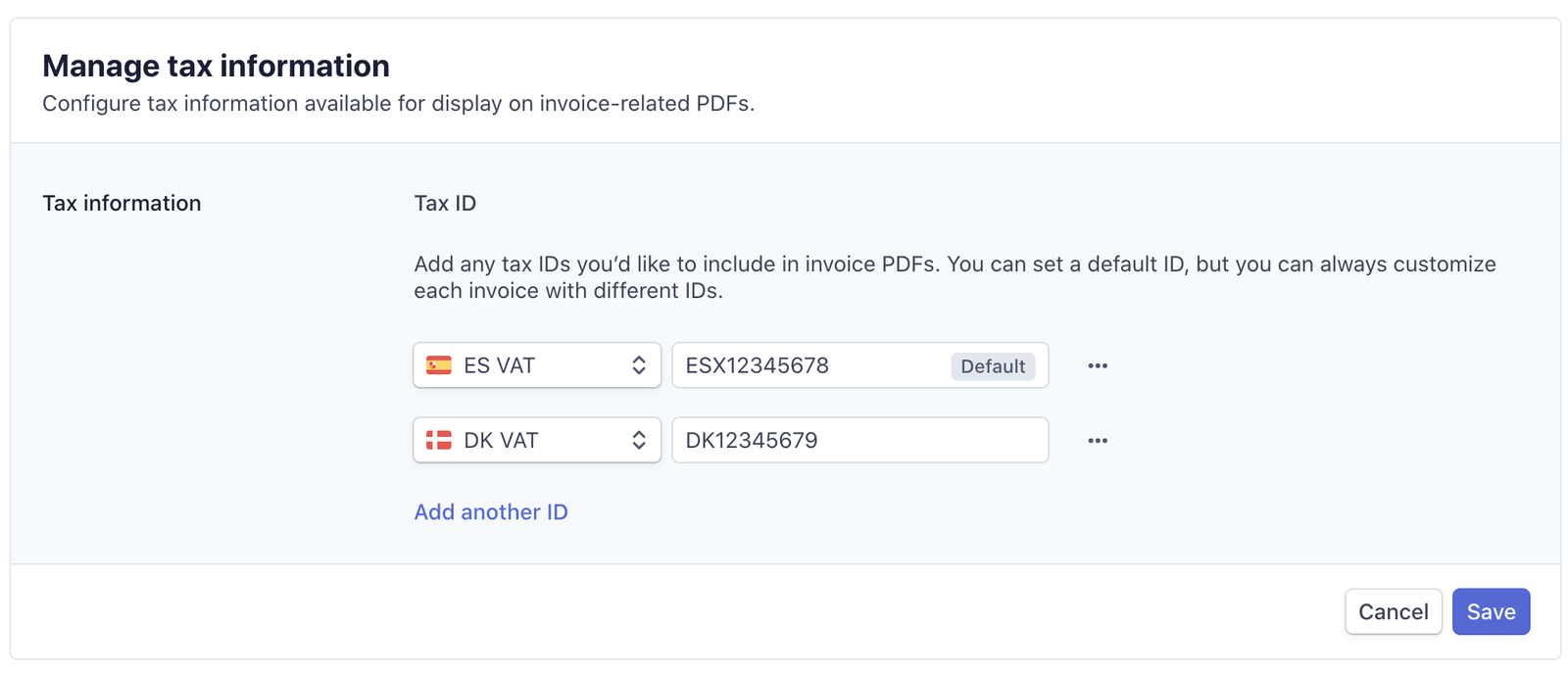

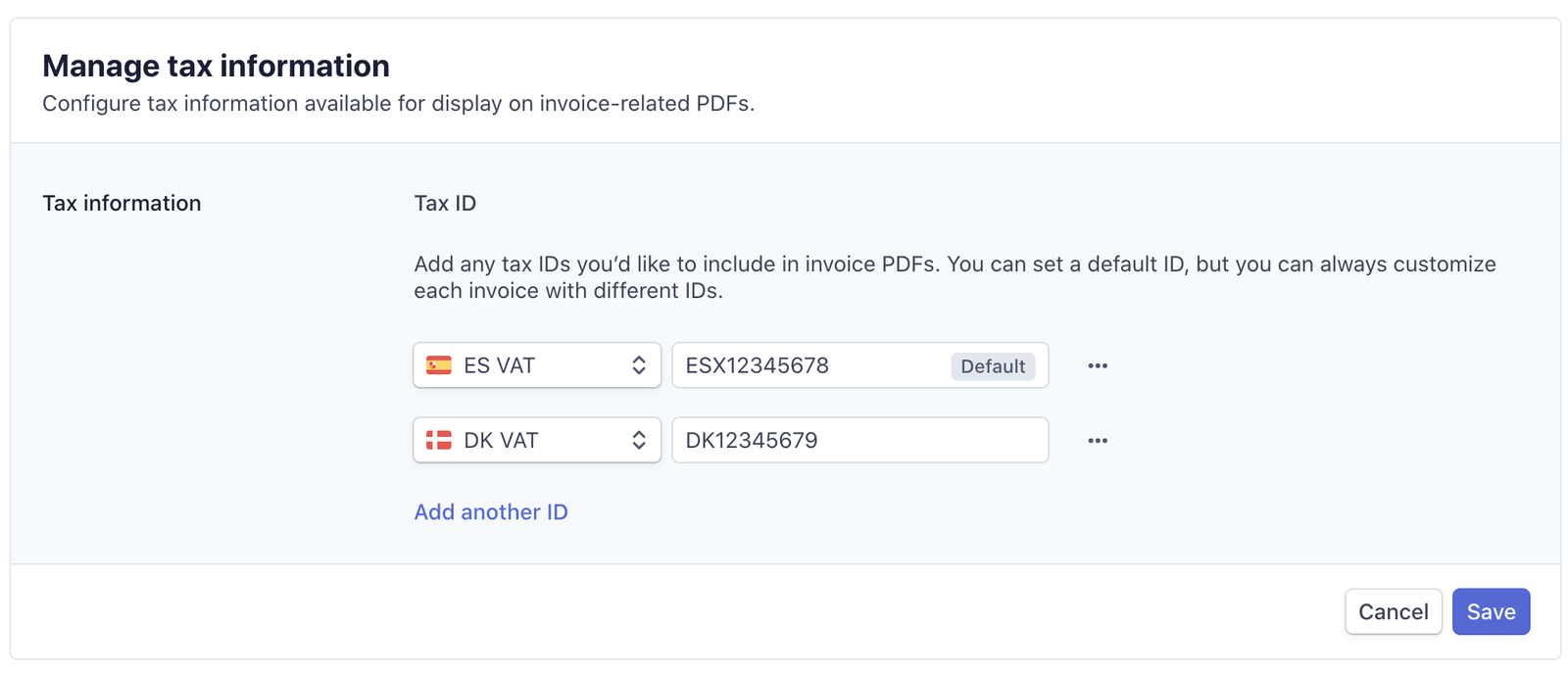

Customer Tax Ids Stripe Documentation

How To Issue Tax Invoice Agoda Partner Hub

Kaospilot Masterclass Master Class Ways Of Learning Learning Spaces

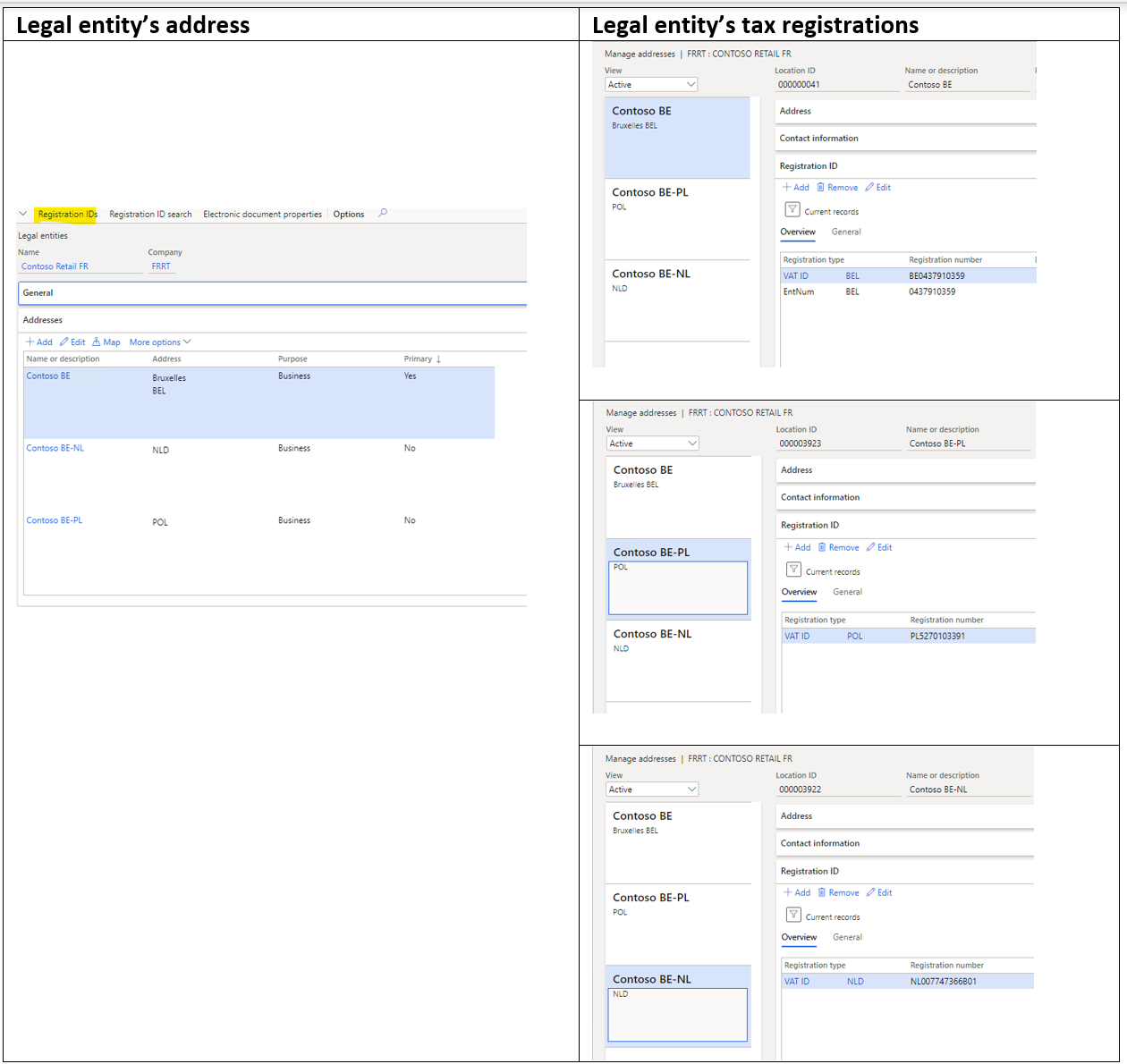

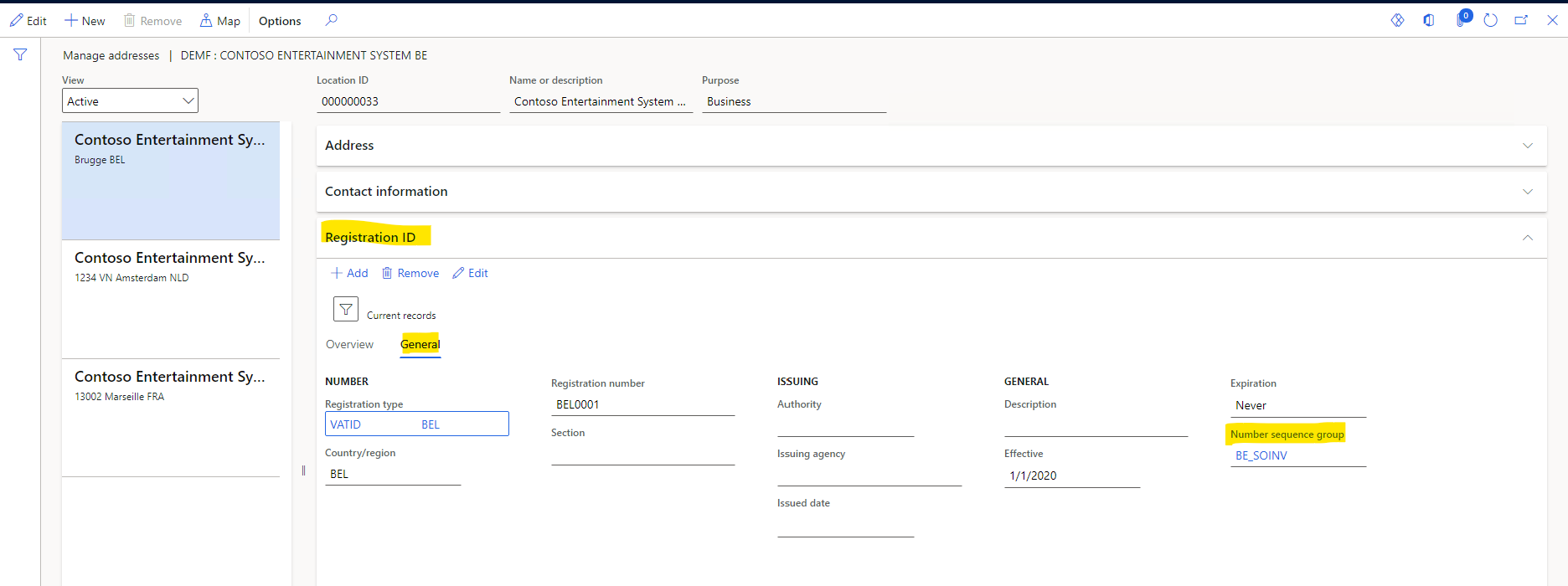

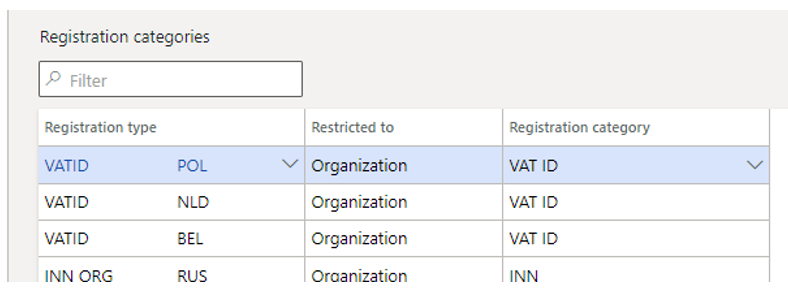

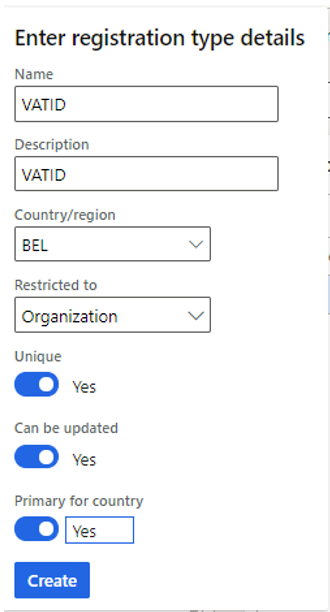

Multiple Vat Registration Numbers Finance Dynamics 365 Microsoft Docs

Multiple Vat Registration Numbers Finance Dynamics 365 Microsoft Docs

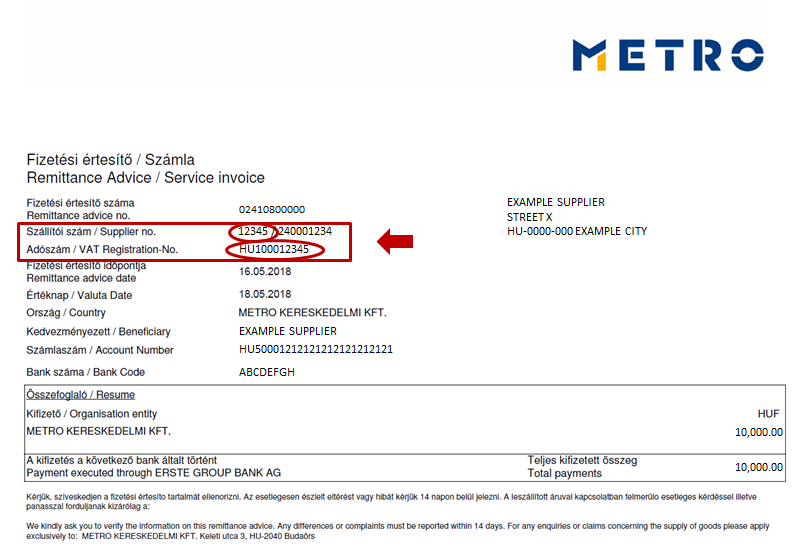

Metro Cash Carry Hungary Supplier Enquiry Form Miag Eform

Account And Customer Tax Ids Stripe Documentation

About Vat In South Korea Help Center Wix Com

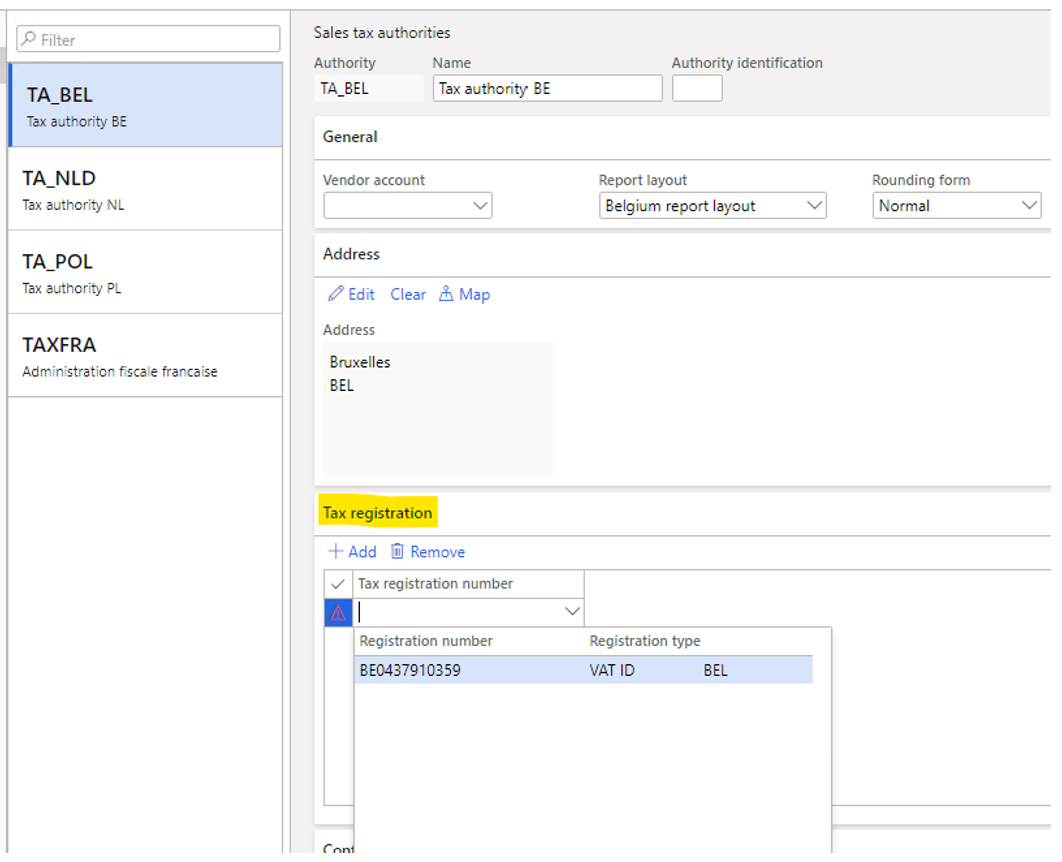

Multiple Vat Registration Numbers Finance Dynamics 365 Microsoft Docs

Add Your Vat Number In Campaign Manager Linkedin Help

Building Contractor Appointment Letter How To Create A Building Contractor Appointment Letter Download This Building C Lettering Letter Templates Templates

How To Order A Medcalc License

Multiple Vat Registration Numbers Finance Dynamics 365 Microsoft Docs

Vat Number The Ultimate Guide Bansar China

Multiple Vat Registration Numbers Finance Dynamics 365 Microsoft Docs

Multiple Vat Registration Numbers Finance Dynamics 365 Microsoft Docs

Multiple Vat Registration Numbers Finance Dynamics 365 Microsoft Docs